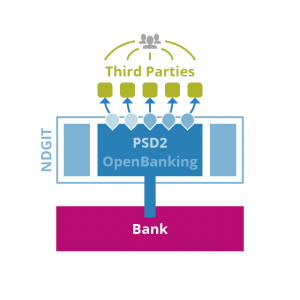

Under pressure: Banks increasingly rely on NDGIT’s standardized software solution for PSD2 implementation

Munich, 6 December 2018

The countdown has begun: On March 14th 2019, the implementation of the Payment Service Directive (PSD2) is entering the crucial phase. Until then, payment services must provide a test environment for their technical interfaces including documentation for account information and payment initiation services. At the moment, many institutes rely on external help, such as NDGIT, provider of the first API platform for banking and insurance in Europe. With “PSD2 Ready”, the technology leader in API management offers a complete solution that can be used immediately. Due to the tight time schedule, a standardized software solution is the last chance for many banks to avoid high penalties from consumers and associations, as the know-how for in-house solutions is often missing.

NDGIT’s PSD2 software is the first and only out-of-the-box solution on the market that can be used immediately and deployed within just 60 working days. The product “PSD2 Ready” offers ready-to-use APIs with backend connectors according to the current, technical standards of the Berlin Group, STET or UK Open Banking. All functions for PSD2 and RTS regulation are already included, from third-party management to PSD2 reports. The software can be flexibly configured for all requirements of complex banking IT and can also be adapted to the various possibilities of API standards and authorization options. NDGIT carries out updates and extensions centrally without having to adapt the individual bank interfaces.

Last Minute Help is needed

The demand for fast and efficient solutions is high. As a hidden champion in API management, NDGIT is already working successfully with over 20 banks in Europe, including UBS, Berner Kantonalbank (BEKB) and Hypothekarbank Lenzburg (HBL). Ascending trend.

This is also confirmed by Oliver Dlugosch, CEO of NDGIT: “More and more banks are discovering that they have miscalculated in the effort estimation of PSD2 implementation. Now, just before the deadline, the pressure is of course very high to implement all technical requirements in time. Banking systems have been designed for decades to be inaccessible from the outside. This paradigm shift is extremely difficult for the banks. But NDGIT can help: Our 50 specialists for Open Banking, API management and payment provide the necessary know-how and are constantly working to meet the big onslaught and make all the banks fit for the PSD2.” Banks benefit from this knowledge from over 20 PSD2 projects and thereby reduce the risks of own developments.

Keyword Open Banking: PSD2 paves the way to a new banking age

PSD2 not only means new obligations for banks, but also great potential and development opportunities for the future. What many do not realize: Just like third party providers (TPPs), banks can also use other bank’s data for innovative product offerings – if they have implemented the digital infrastructure.

As early as 2017, NDGIT launched the first Open Banking in Switzerland together with Hypothekarbank Lenzburg and was honored with the Euro Finance Tech Award. The Swiss bank selected NDGIT’s Open Banking out-of-the-box solution for the choice of partner. This offers the flexible and expandable opening of traditional banking systems to implement their digital strategies, from PSD2 via Open Banking to the creation of ecosystems.

The goal: easier access for new providers, a large variety of bank-independent services and, last but not least, more customer-friendly applications.

About NDGIT GmbH

NDGIT GmbH stands for Next Digital Banking and provides the first API platform for banking and insurance. It connects banks and FinTech companies with digital ecosystems. This technology enables banks to open themselves up to digital partners with open banking APIs and PSD2 solutions. In this way, the NDGIT FinTech platform forms the technological backbone for new applications and IT landscapes in banking and insurance. In 2017 NDGIT implemented the first open banking system for Switzerland and was honoured with the Euro Finance Tech Award 2017 for the best co-operation between a bank and FinTech.